Mistakes to Watch Out For When Creating an Offshore Trust

Mistakes to Watch Out For When Creating an Offshore Trust

Blog Article

Find out How an Offshore Trust Can Improve Your Estate Planning Technique

If you're wanting to reinforce your estate preparation technique, an offshore Trust could be the option you require. These trusts provide special advantages that can secure your assets while offering tax obligation and personal privacy advantages. However, numerous people have misunderstandings regarding exactly how they work and their importance. Comprehending these aspects can be necessary for your financial future. Let's explore what an offshore Trust can do for you.

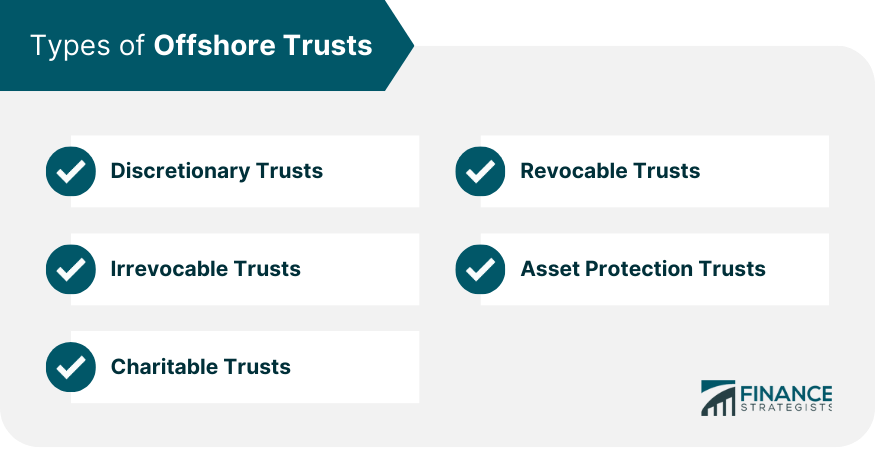

Recognizing Offshore Trusts: What They Are and Just How They Work

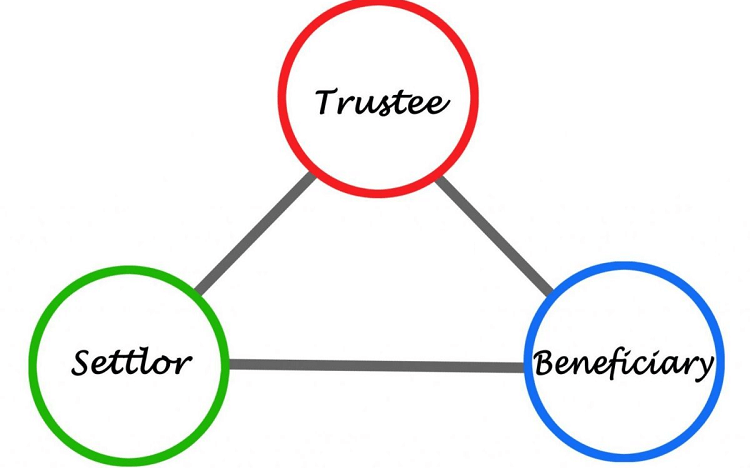

Offshore trusts are powerful economic devices that can aid you handle your assets while giving benefits like personal privacy and tax benefits. Primarily, an overseas Trust is a legal plan where you transfer your properties to a trust fund developed in an international territory. This arrangement enables you to different ownership from control, suggesting you don't straight own the possessions any longer; the Trust does.

You'll select a trustee to handle the Trust, guaranteeing your assets are handled according to your dreams. This arrangement usually secures your possessions from creditors and lawful claims, as they're held in a various legal system. Furthermore, you can define how and when beneficiaries receive their inheritance, adding a layer of control to your estate preparation. By comprehending exactly how offshore trust funds work, you can make enlightened decisions that straighten with your financial objectives and supply assurance for your family members's future.

Secret Advantages of Offshore Depends On for Property Protection

While you might not constantly be able to forecast financial difficulties, developing an offshore Trust can be an aggressive action towards safeguarding your assets. One vital benefit is the included layer of safety and security it anticipates creditors and legal judgments. By positioning your properties in an offshore Trust, you develop an obstacle that makes it harder for possible plaintiffs to reach your riches.

In addition, overseas trusts can help you guard your possessions from economic or political instability in your home nation. This geographical splitting up guarantees that your wide range stays safe, also if your residential situation adjustments suddenly.

Another benefit is the potential for anonymity. Several overseas territories permit greater privacy, making it tough for others to discover your financial holdings. This privacy can discourage pointless lawsuits and unwanted attention. On the whole, an offshore Trust can be a powerful device in your asset security method, giving you satisfaction.

Tax Advantages of Establishing an Offshore Trust

When you establish an offshore Trust, you not only improve your asset security yet additionally expose useful tax deferral chances. This can significantly lower your gross income and assist your riches expand over time. Recognizing these advantages can be a game-changer in your estate planning method.

Possession Security Conveniences

Developing an offshore Trust can greatly improve your possession security method, especially if you're wanting to protect your wealth from financial institutions and lawful judgments. By positioning your assets in a trust, you effectively separate them from your individual estate, making it harder for creditors to access them. This included layer of protection can deter legal actions and supply assurance.

In addition, numerous overseas jurisdictions have durable personal privacy regulations, ensuring your monetary affairs remain private. In case of legal disputes, having properties held in an offshore Trust can complicate efforts to confiscate those assets, as it's more difficult for financial institutions to navigate international legislations. Ultimately, an offshore Trust is an effective device in guarding your wealth for future generations.

Tax Obligation Deferral Opportunities

Offshore trust funds not only use durable possession defense but likewise existing significant tax obligation deferral chances. By placing your assets in an overseas Trust, you can potentially defer tax obligations on revenue and funding gains till you take out those funds. This strategy allows your financial investments to grow without immediate tax obligations, optimizing your wide range with time.

In addition, depending upon the jurisdiction, you could benefit from reduced tax rates and even no tax obligations on particular kinds of income. This can supply you with a much more beneficial atmosphere for your investments. Using an offshore Trust can enhance your total estate preparation method, allowing you to manage your tax obligation direct exposure while securing your assets for future generations.

Enhancing Personal Privacy and Confidentiality With Offshore Depends On

While lots of people seek ways to safeguard their possessions, utilizing overseas trusts can considerably improve your privacy and discretion. By putting your possessions in an overseas Trust, you produce a layer of defense versus possible financial institutions, claims, and public analysis. This framework generally guarantees that your individual info continues to be exclusive, as offshore territories typically offer stringent discretion regulations.

Additionally, the possessions held in the Trust are not openly revealed, enabling you to manage your wealth discreetly. You can additionally control how and when beneficiaries access their inheritances, better pop over here shielding your intentions from prying eyes.

In addition, the intricate legal frameworks of overseas counts on can discourage those attempting to test or access your properties (offshore trust). Eventually, selecting an offshore Trust equips you to maintain your monetary privacy, offering peace of mind as you browse your estate intending journey

Preparation for Future Generations: Riches Transfer Strategies

As you consider the privacy benefits of overseas counts on, it's equally important to consider just how to effectively hand down your wealth to future generations. Offshore counts on can function as powerful tools for riches transfer, allowing you to dictate how and when your possessions are distributed. By developing an offshore Trust, you can establish particular terms to guarantee that your beneficiaries receive their inheritance under problems that align with your values.

Additionally, overseas counts on typically offer tax obligation advantages, which can aid preserve your riches for future generations. You can structure the Trust to safeguard your properties from financial institutions or legal insurance claims, assuring that your loved ones profit from your hard work.

Typical Misconceptions About Offshore Counts On

What do you actually know concerning offshore trusts? Lots of people believe they're only for the ultra-wealthy or those trying to hide assets. Actually, offshore counts on can be legitimate devices for estate preparation and asset defense for a larger audience. One more typical misunderstanding is that they're constantly unlawful or underhanded. While it's true that some misuse them for tax evasion, an appropriately established offshore Trust abides by lawful requirements and can offer significant advantages. You could likewise think that setting one up is overly complicated or expensive. While there are considerations, lots of find that the benefits surpass the initial investment. Lastly, some fear blowing up over their properties. Nevertheless, with the appropriate framework and trustees, you can keep a level of oversight and versatility. By recognizing these false impressions, you can make educated decisions regarding whether an overseas Trust fits your estate preparation strategy.

Steps to Establishing an Offshore Trust as Part of Your Estate Plan

Picking a Territory

Choosing the right jurisdiction for your overseas Trust is important, as it can greatly influence the efficiency of your estate plan. Begin by looking into nations with favorable Trust legislations, tax obligation advantages, and solid possession security. Additionally, think about the costs associated with establishing up and preserving the Trust in that jurisdiction, as fees can vary substantially.

Choosing a Trustee

How do you ensure your overseas Trust operates smoothly and properly? The vital lies in picking the best trustee. You'll want a person trustworthy, experienced, and knowledgeable regarding the legislations governing your picked jurisdiction. Consider professionals like attorneys or economic consultants that concentrate on offshore trust funds. They comprehend the nuances of managing properties across borders and can browse possible legal intricacies (offshore trust).

A solid reputation can provide you self-confidence that your Trust will certainly be managed effectively, straightening with your estate planning goals. Choose wisely, and your overseas Trust can thrive.

Funding the Trust

As soon as you've chosen the appropriate trustee for your overseas Trust, the following action is funding it properly. You'll wish to transfer possessions into the depend ensure it accomplishes your estate preparing goals. Start by determining which properties to consist of-- this might be cash money, financial investments, genuine estate, or company interests. Then, seek advice from your trustee and legal consultant to determine the most effective method for moving these assets.

Keep in mind the tax ramifications and the guidelines of the offshore territory. Ensure to record each transfer effectively to keep transparency and adhere to legal requirements. As soon as funded, your offshore Trust can offer the benefits you seek, such as possession security and tax efficiency, enhancing your overall estate planning technique.

Often Asked Questions

What Is the Difference In Between an Offshore Trust and a Domestic Trust?

An overseas Trust's possessions are held outside your home nation, providing privacy and possible tax benefits. On the other hand, a domestic Trust runs within your country's regulations, typically lacking the exact same degree of asset defense and privacy.

Can I Handle My Offshore Trust Properties Directly?

You can not manage your overseas Trust possessions directly because of lawful restrictions. Instead, a trustee supervises those assets, making sure compliance with regulations and protecting your passions while you profit from the Trust's benefits.

Are Offshore Trusts Legal in My Country?

Yes, overseas trust funds are lawful in many nations, but guidelines differ. You'll find here need to research your nation's regulations or get in touch with a lawful expert to assure conformity and comprehend any kind of tax obligation implications involved.

Just how much Does It Expense to Establish an Offshore Trust?

Establishing up an overseas Trust usually sets you back between $5,000 and $20,000, depending on the complexity and jurisdiction. You'll want to speak with a lawful specialist to get a precise price quote for your specific demands.

What Takes place to My Offshore Trust if I Move Nations?

If you relocate countries, your overseas Trust's tax obligation ramifications and legal standing might change. You'll require to seek advice from professionals in both jurisdictions to ensure compliance and make required modifications to keep its securities and advantages.

Final thought

Integrating an offshore Trust into your estate planning can be a game-changer. It not just guards your possessions from possible risks but also uses tax benefits and boosts your personal privacy. By preparing for future generations, you'll ensure your wide range is maintained and passed on according to your desires. Don't allow misconceptions hold you back; with the best advice, you can develop an overseas Trust that truly protects your legacy. Start discovering your choices today!

Basically, an overseas Trust is a legal arrangement where you transfer your assets to a trust fund developed in an international territory. In the event of legal disagreements, having possessions held in an overseas Trust can make complex efforts to confiscate those possessions, as it's even more challenging for lenders to navigate foreign browse around here laws. Making use of an offshore Trust can boost your general estate preparation method, allowing you to manage your tax direct exposure while securing your properties for future generations.

As soon as funded, your offshore Trust can supply the benefits you look for, such as asset protection and tax efficiency, improving your total estate planning technique.

What Is the Distinction Between an Offshore Trust and a Residential Trust?

Report this page